8 Company Investment and Project Management

Chapter 8 Company Investment and Project Management

Overview and Background

Previously, we discussed stock markets. Stock markets and stock prices are one way to gauge a company's (and the overall economy's health). Companies sell stock (through Initial Public Offering also called IPOs) and bonds to raise funds. However, the investors need to know how these funds would be utilized. One way to demonstrate the use of funds (especially when the project has foreseeable cash flows) is to demonstrate the profitability of the project. Since cash flows are staggered over a period of time, these need to be discounted. This module introduces a student to the concepts of Net Present Value (NPV) to assess the profitability of a new project; Internal Rate of Return (IRR) to find out the return from a project for comparison with returns from comparable activities, Profitability Index to compare multiple projects and the Payback rule to obtain information about the time period required to break even.

Learning Objectives

Upon completion of this chapter, you should be able to:

- Apply capital budgeting to project management decisions.

- Interpret the use of payback period and discounted payback period to find out the usefulness of projects for a company

- Apply the concept of Net Present Value (NPV) to decide on the adoption of new projects.

- Apply the concept of Internal Rate of Return (IRR) to decide on the adoption of new projects.

- Apply the concept of NPV and IRR into real world problems.

- Deduce NPV profile against discount rates.

- Analyze new projects using the concept of Internal Rate of Return (IRR).

- Discuss problems with IRR.

- Analyze crossover rate for mutually exclusive projects.

- Apply profitability index to deduce the best project to choose among a variety of projects with positive NPV.

8.1 Introduction

Having seen how bond markets and stock markets work, we need to look at financial aspects of cash flows that are not related to a specific debt or equity instrument. These cash flows can be associated with projects that involve significant capital outlays and must be evaluated for profitability. A company has a decision to make about using its profits. Some companies like Amazon and Netflix mostly plowed back their profits in the 2000s and 2010s to reinvest them in business operations because they felt they could give their shareholders better returns by investing in themselves. How do companies evaluate these returns? How do companies know there are some cash flows that make sense and others that do not?

8.2 Net Present Value

First, let us discuss the intuition behind interest rates and the opportunity cost of capital. Let us say we have $ 2.5 billion in funds. We could either start a small aircraft leasing company or deposit the money in a bank and earn a rate of return from that investment, and that is the best alternative available without increasing the risk. The former is called project investment and the return from this is called the internal rate of return (from the project), while the latter is called alternative opportunity and its return so obtained is called the opportunity cost of capital. For example, if this investment of $ 2.5 billion gets a return of 5%, that will be called the internal rate of return. If alternative investment in a certificate of deposit produces a yield of 5.5%, then the opportunity cost of capital is 5.5%. This opportunity cost of capital is used as the discount rate for (net) present value calculations. We will be defining net present value a little later in this chapter.

8.2.1 Net Present Value: Single Cash Flow After Investment

Example 8.1

MKZ airlines is planning a project investment: the purchase of 3 Cessna aircraft to fly a specific route. The cost of acquisition of aircraft (including all charges) is $ 2,000,000. It is expected that annual net revenue from operations will be $ 1,500,000 and thereafter the aircraft will be sold for $ 1.2 million. This yields a total net cash flow of $ 2.7 million from operations.

The alternative opportunity MKZ is considering is to invest the money in non-risky bonds at 3.5%. Please calculate and/ or report:

- the opportunity cost of capital

- present value of investment in real project

- net present value of investment in real project

Answer:

- The opportunity cost of capital is the alternate return on investment obtained = 3.5%

- The present value from investing in the project is

- [latex]PV = \frac{2,700,000}{1.035} \approxeq $ 2,608,696[/latex]

- Since this value is now equivalent to the period zero, we can compare this with initial cash (out) flow. Comparing generates the net present value of $608,696 (2,608,696 – 2,000,000).

Video demonstration of this example in MS Excel here.

Note in Example 8.1 that this value is positive, indicating that the project investment will give us better future value than the alternative opportunity of investing in safe bonds. Let us look at it in Example 8.2.

Example 8.2:

Consider the purchase of Cessna aircraft by MKZ airlines in Example 8.1 above. The opportunity cost of capital is 3.5% from investing in the best alternate option – government bond for 1 year. The investment in Cessna for 1 year, and resale of the used aircraft thereafter produces a cash flow of $ 2.7 million net of operating and other expenses. Is this a better investment than investing in bonds?

Answer:

Investing in bonds yields

When we compare 2,070,000 with 2,700,000, investing in bond is inferior as compared to the Cessna project. Therefore, investing in bonds is not a better investment than investing in the aircraft, and MKZ should invest in the project investment. One aspect to note about real projects being evaluated at the opportunity cost of capital is that real projects are risky.

Video demonstration of this example in MS Excel here.

There is a probability that these projects could turn into a less profitable or even a loss-making opportunity. Let us see an illustration in Example 8.3 below.

Example 8.3

KMZ airlines, a competitor of MKZ airlines, considers entering the same market. Their marketing manager estimates the same initial cost of $ 2 million. However, since the market is getting saturated, the manager estimates that cash flow thus produced is $ 800,000 from operations (net revenue) and $ 1.25 million from resale. A financial analyst at the company estimates that the opportunity cost of capital is 3.5% obtained by investing in safe bonds. Calculate the net present value at the opportunity cost of capital of 3.5%. Also compare the future value of the two investments.

Answer:

Cash flow at the end of 1-year is 2,050,000.

The present value of this at 3.5% is

[latex]PV = \frac{2,050,000}{1.035} \approxeq 1,981,000[/latex]

When we compare it with initial cost, we get a net present value of -19,000 (1,981,000 – 2,000,000).

Thus, we should not purchase the aircraft needed to operate in this market.

Looking at future values, the future net cash flow from operations would be 2,050,000.

However, the future cash flow from bond investment would be

In the above example, the alternate opportunity produces bigger cash flow. This is because the rate of return from the alternate investment is so high that it causes discounted values of cash flows to shrink. This higher discount rate produces a negative net present value even though (not net but future) cash flow from operating aircraft and reselling it was positive and larger than initial outlay. This is because even when projects return initial capital, sometimes they produce cash flows that are inferior to the next best opportunity. This example underscores the significance of this chapter: your ability to compare the estimated revenues of two potential investments could lead to significant profit or loss for the company for which you are working. This is one reason why the job of a financial analysts is so important for the organization. Simply put, if the analyst had made a mistake in the above calculation that returns from alternative investments were 2.0% instead, then present value of internal project at 2.0% would be [latex]PV = \frac{2,050,000}{1.025} \approxeq 2,010,000[/latex] . 2% rate gives a net present value of +10,000. We observe that the same project cash flows produce opposite results.

Net present value is therefore the sum of present value of all future cash inflows (and outflows) and the initial cash (usually) outflow, which is the cash outflow from initial investment. If the opportunity cost increases, our project becomes more infeasible because future cash flows (usually these are inflows) become less valuable today. As an example (Example 8.4), let us re-consider the context of Example 8.1 again with one important change.

Example 8.4

MKZ airlines is planning a project investment: the purchase of 3 Cessna aircraft to fly at a specific route. The cost of acquisition of aircraft (including all charges) is $ 2,000,000. It is expected that one year net revenue from operations will be $ 1,500,000 and thereafter the aircraft will be sold for $ 1.2 million. This yields a total net cash flow of $ 2.7 million from operations.

The alternative opportunity MKZ is considering is to invest the money in more risky and longer duration bonds at 4.5%. Please calculate and/ or report:

- the opportunity cost of capital

- present value of investment in real project

- net present value of investment in real project

Answer:

- The opportunity cost of capital is the alternate return on investment obtained = 4.5%

- The present value from investing in the project is[latex]PV = \frac{2,700,000}{1.045} \approxeq 2,584,000[/latex]

- Comparing generates the net present value of $584,000, which is lower than $608,696.in example 8.1. Thus, as opportunity cost increased, the net present value decreased. That is, the project investment became less valuable.

Video demonstration of this example in MS Excel here.

8.2.2 Net Present Value: Multiple Cash Flows After Investment

So far, we’ve seen the projects in which there is an outlay of capital and there is a single cash flow in the next period. How does the situation change when we have multiple cash flows? The situation is analyzed in a similar way: finding present value of cash flows and comparing with initial cash outflow to compute the net present value of the investment as seen in Example 8.5 below.

Example 8.5

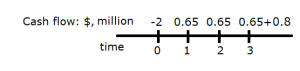

MKZ airlines is planning a project investment: the purchase of 3 Cessna aircraft to fly at a specific route. The cost of acquisition of aircraft (including all charges) is $ 2,000,000. It is expected that one year net revenue from operations will be $ 650,000 for three years (always end of the year) and the aircraft will be sold for $ 800,000 at the end of the third year. The alternative opportunity with MKZ is to invest the money in safe bonds at 3.5%. Please show/ calculate and/ or report:

- cash flows in a diagram

- present value of positive cash flows

- net present value of the investment

Answer:

- Cash flow diagram is as in Figure 8.1 below. Numbers at the top are dollar values (with appropriate signs) and represent cash flows from the Cessna project.

- [latex]PV_{inflows} = \frac{650,000}{1.035^1}+\frac{650,000}{1.035^2}+\frac{1,450,000}{1.035^3} \approxeq $ 2,540,000[/latex]

- Net present value is $ 540,000 and is positive, which implies that the company should go ahead with the project.

Video demonstration of this example in MS Excel here.

8.3 Decision of the Timing of the Investment: PV of NPV

The concept of net present value can be applied for projects that have multiple times when investments can be made. Let us see Example 8.6 below.

Example 8.6

MKZ airlines can either invest in the Cessna project now for $ 2 million or any time in the next five years. The CFO of company estimates that the cost of investment increases by 10% every year from now for 2 years due to high inflation currently. The subsequent increase would be 7%, 5% and 3% for years 3, 4 and 5 respectively. The present value of cash inflows is 2.54 million now. This value after 1 year would be 2.48 million due to expected recession, 2.69 million after year 2, 3.12 million after year 3, 3.45 million after year 4 and 3.55 million after year 5. When should MKZ airlines invest in the project if the discount rate is 3.5%?

Answer:

To solve this, refer to Table 8.1 below:

|

|

Cost of investment |

PV of cash inflowst |

NPVt |

PVNPV |

|

Now (t=0) |

2,000,000 |

2,540,000 |

540,000 |

540,000 |

|

Year 1 |

2,200,000 |

2,480,000 |

280,000 |

270,531 |

|

Year 2 |

2,420,000 |

2,690,000 |

270,000 |

252,048 |

|

Year 3 |

2,589,400 |

3,120,000 |

530,600 |

478,571 |

|

Year 4 |

2,718,870 |

3,450,000 |

731,130 |

637,138 |

|

Year 5 |

2,800,436 |

3,550,000 |

749,564 |

631,113 |

As seen in Table 8.1, the present value of net present value at each point in time is in column titles PVNPV at the right. The greatest value is in year 4 and therefore MKZ should launch the project at the end of year 4.

Video demonstration of this example in MS Excel here.

The concept of net present value can be applied to projects whose cash flows are over unequal time periods. Understandably, projects with longer duration of cash flows will have greater net present value. Let us see Example 8.7 below to illustrate that.

Example 8.7

Let us compare Example 8.1 with exact cash flows in Example 8.5.

In Example 8.1, MKZ airlines is planning to purchase 3 Cessna aircraft for 1 year before reselling them. The cost of acquisition of aircraft is $ 2,000,000. The cash inflows would be $ 1,500,000 (net revenues) and $ 1.2 million (resale). This yields a total net cash flow of $ 2.7 million at the end of one year.

In Example 8.5, MKZ airlines is planning to purchase 3 Cessna aircraft for 3 years. The cost of acquisition of aircraft is the same ($ 2,000,000). However, now for the sake of comparison, let us modify that the cash flows will be $ 1,500,000 every year for three years and $ 1,200,000 at the end of the third year (resale). The opportunity cost of capital is 3.5%.

Using the regular procedure, please compute the NPV and compare them.

Answer:

We have modified Example 8.5 to match up with cash flows of example 8.1. This yields interesting results as seen in Table 8.2 below:

|

Time |

Cash flows (Example 8.1) |

Cash flows (Example 8.5 modified) |

|

0 |

-2,000,000 |

-2,000,000 |

|

1 |

2,700,000 |

1,500,000 |

|

2 |

|

1,500,000 |

|

3 |

|

2,700,000 |

|

NPV |

608,696 |

3,284,787 |

Video demonstration of this example in MS Excel here.

In Example 8.7 above, we notice that last cash flows are the same for each situation ($ 2.7 million). However, in the real world, the last (terminal) cash flows may not be the same. Let us see a situation like Example 8.8.

Example 8.8

Let us still compare Example 8.1 with Example 8.5. In Example 8.1, MKZ airlines is planning to purchase 3 Cessna aircraft for 1 year before reselling them. The cost of acquisition of aircraft is $ 2,000,000. The cash inflows would be $ 1,500,000 (net revenues) and $ 1.2 million (resale). This yields a total net cash flow of $ 2.7 million at the end of one year.

In Example 8.5, MKZ airlines is planning to purchase 3 Cessna aircraft for 3 years. The cost of acquisition of aircraft is the same ($ 2,000,000). However, now for the sake of comparison, let us modify the cash flows will to $ 650,000 every year for three years and $ 1,200,000 at the end of the third year (resale). The opportunity cost of capital is 3.5%.

Using the regular procedure, please compute the NPV and compare them.

Answer:

We have modified Example 8.5 to match up with cash flows of Example 8.1. This yields interesting results as seen in Table 8.3 below:

|

Time |

Cash flows (Example 8.1) |

Cash flows (Example 8.5) |

|

0 |

-2,000,000 |

-2,000,000 |

|

1 |

2,700,000 |

650,000 |

|

2 |

|

650,000 |

|

3 |

|

1,850,000 |

|

NPV at 3.5% |

608,696 |

903,395 |

Video demonstration of this example in MS Excel here.

As we can observe, the net present value has increased because of new cash flows added to the project. However, this is not universally true, particularly if the new cash flows are a lot smaller or if there are some negative cash flows added along the way.

8.4: Equivalent Annual Annuity (EAA)

8.4.1: Projects with Unequal Lives and Replacement Projects

In the above case, comparing the projects is still relatively easy, particularly because the initial cash outflows are the same. However, even then, the final cash flows are different. Hence, we need to compare the two cash flow streams.

One way to compare them is to use NPV approach. However, it provides a misleading picture since the two projects have unequal lives. The other way is to compare using the equivalent annual annuity (EAA) method. This method calculates the NPV or value today of each project and then computes the equivalent payment per period for the life of each project. EAA provides a clearer picture of the equivalent cost/ benefit from carrying out the project for the time in which it is stipulated to end.

Example 8.9

Let us compare projects in Example 8.8 using equivalent annual annuity method. What is the net cost/ benefit of cash flows from Examples 8.1 and 8.5 at 3.5%. Based on this, which project would be recommended?

We find that the two projects have unequal lives. Hence NPV does not provide a clear picture of which project is superior per year. Therefore, we use the method of equivalent annual annuity corresponding to the period for which the project is carried out in Table 8.4 below.

|

Time |

Cash flows (Example 8.1) |

Cash flows (Example 8.5) |

|

0 |

-2,000,000 |

-2,000,000 |

|

1 |

2,700,000 |

650,000 |

|

2 |

|

650,000 |

|

3 |

|

1,850,000 |

|

NPV at 3.5% |

608,696 |

903,395 |

|

EAA at 3.5% |

$630,000 |

$322,453 |

Video demonstration of this example in MS Excel here.

Using the illustration above, it is clear that the equivalent annual benefit from project in Example 8.1 is much more profitable than that in Example 8.5. Hence, it is recommended to sell the project after 1 year.

8.4.2: Replacement of old machine

The concept of equivalent annual annuity can be useful for machines with unequal lives or for finding a replacement of an existing machine with a new one. Sometimes what seems to be a cheap machine may not be cheap after all! Let us see that in Example 8.10 below.

Example 8.10

MKZ airlines currently has A220s on their fleet that need $ 16 million to maintain per year.2 3

Their general manager Mr. Aykan is wondering whether he can replace these aircraft with more energy efficient models which cost $ 34 million4 upfront and $ 11.75 million per year for maintenance. For simplicity, his maintenance manager Ms. Doshi estimates that both existing and new aircraft will be used for the next 10 years.

Please use our going discount rate of 3.5% to answer the following questions:

- Is it better to purchase new aircraft or continue with the existing ones?

- If the existing aircraft only had a useful life of 5 years, how does the comparison change now?

- If the discount rate increases, what is that discount rate that makes us indifferent between the two options? What happens if the discount rate increases further?

Answer:

Part a: Is it better to purchase new aircraft or continue with the existing ones?

Let us set up a cash flow table and find the net present values first. The existing project has no cash outflow at t=0. However, the new one has -$3 million. The existing project has annual outflows of $ 16 million but the new one has $ 11.75 million. Let us observe that and its NPV in Table 8.5a below:

|

Time |

Existing |

New |

|

0 |

0 |

-34.00 |

|

1 |

-16.00 |

-11.75 |

|

2 |

-16.00 |

-11.75 |

|

3 |

-16.00 |

-11.75 |

|

4 |

-16.00 |

-11.75 |

|

5 |

-16.00 |

-11.75 |

|

6 |

-16.00 |

-11.75 |

|

7 |

-16.00 |

-11.75 |

|

8 |

-16.00 |

-11.75 |

|

9 |

-16.00 |

-11.75 |

|

10 |

-16.00 |

-11.75 |

|

NPV at 3.5% |

-133.07 |

-131.72 |

|

EAA at 3.5% |

-16.00 |

-15.84 |

As seen from Table 8.5a above, we can see that existing project has a greater (negative) NPV of maintenance. Therefore, its equivalent annual annuity (or net annual cost including discount rate) is also more expensive. But we also notice that (not so) weirdly, the EAA for existing project is $16 million, which is the annual maintenance cost. This is because the NPV and EAA are calculated on an annuity using the same discount rate.

Part b: If the existing aircraft only had a useful life of 5 years, how does the comparison change now?

Now, we modify the cash flows for existing project in Table 8.5a to only 5 years. This is seen in Table 8.5b below:

|

Time |

Existing |

New |

|

0 |

|

-34.00 |

|

1 |

-16.00 |

-11.75 |

|

2 |

-16.00 |

-11.75 |

|

3 |

-16.00 |

-11.75 |

|

4 |

-16.00 |

-11.75 |

|

5 |

-16.00 |

-11.75 |

|

6 |

|

-11.75 |

|

7 |

|

-11.75 |

|

8 |

|

-11.75 |

|

9 |

|

-11.75 |

|

10 |

|

-11.75 |

|

NPV at 3.5% |

-72.24 |

-131.72 |

|

EAA at 3.5% |

-16.00 |

-15.84 |

As seen from Table 8.5b above, we can see that the existing project now has a lower (negative) NPV of maintenance. But its equivalent annual annuity (or net annual cost including discount rate) is still more expensive. This is because, as noticed above that NPV and EAA are calculated on an annuity using the same discount rate. But now, we can see clear benefits of proceeding with the new project because of its lower annual equivalent cost despite higher set-up cost.

Part c: If the discount rate increases, what is that discount rate that makes us indifferent between the two options? What happens if the discount rate increases further?

Now we change the rate to make the two cash flows have the same EAA. This is straightforward in MS Excel®. We create a cell in which we find the difference between the two EAA’s and set it to zero using goal seek by changing the interest rate which is in another cell. Doing so gives us a rate of 4.28%

|

Time |

Existing |

New |

|

0 |

|

-34.00 |

|

1 |

-16.00 |

-11.75 |

|

2 |

-16.00 |

-11.75 |

|

3 |

-16.00 |

-11.75 |

|

4 |

-16.00 |

-11.75 |

|

5 |

-16.00 |

-11.75 |

|

6 |

|

-11.75 |

|

7 |

|

-11.75 |

|

8 |

|

-11.75 |

|

9 |

|

-11.75 |

|

10 |

|

-11.75 |

|

NPV at 4.28% |

-127.98 |

-127.98 |

|

EAA at 4.28% |

-16.00 |

-16.00 |

Table 8.5d represents the NPV and EAA at different discount rates

|

rate |

NPVexisting |

NPVnew |

EAAexisting |

EAAnew |

|

3% |

-73.28 |

-134.23 |

-16 |

-15.74 |

|

3.50% |

-72.24 |

-131.72 |

-16 |

-15.84 |

|

4.28% |

-70.67 |

-127.99 |

-16 |

-16.00 |

|

5% |

-69.27 |

-124.73 |

-16 |

-16.15 |

|

5.50% |

-68.32 |

-122.57 |

-16 |

-16.26 |

As we can see, beyond a rate of 4.28%, the equivalent annual cost of new project becomes more expensive. This demonstrates the moving parts that need to be handled in new project management.

Video demonstration of this example in MS Excel here.

8.5: Payback Period and Discounted Payback Period

8.5.1 Payback Period

For a project, payback period is defined as time in which cost of the project is covered with the help of cash inflows. Let us look at an example using data from Example 8.5.

Example 8.11

MKZ airlines is planning to purchase 3 Cessna aircraft to fly at a specific route. The cost of acquisition of aircraft (including all charges) is $ 2,000,000. It is expected that annual net revenue from operations will be $ 650,000 for three years (always end of the year) and the aircraft will be sold for $ 800,000 at the end of the third year. Please calculate the payback period for this project.

|

Column 1 |

Column 2 |

Column 3 |

|

Time |

Cash flows (Example 8.5) |

Cumulative cash flow (Ignoring present value) |

|

0 |

-2,000,000 |

-2,000,000 |

|

1 |

650,000 |

-1,350,000 |

|

2 |

650,000 |

-700,000 |

|

3 |

1,850,000 |

1,150,000 |

In column 3, we just keep adding each cash flow to the previous remaining value. Accordingly, in cell that corresponds to time = 0, the value of cumulative cash flow is minus 2 million. Similarly, as we proceed to the cell that corresponds to time = 1, we add the cash flow of 650,000 to -2,000,000 to get -1,350,000. Then, as we proceed to next cells (time = 2 and time = 3) we repeat this calculation to discover that the cash flows become positive for the first time between 2 and 3 years. Since we had to cover -700,000 but actually covered 1,850,000, we can divide 700/1850 to obtain 0.38 years.

Consequently, the project payback period is 2.38 years.

Video demonstration of this example in MS Excel here.

8.5.2 Discounted Payback Period

However, as noted above, it is not fair to compare two sums of money at different periods of time as equally important. Discounted payback period corrects that problem as it considers time value of money (assigns a greater value to recent amounts and less to future amounts). We note this in Example 8.12 below.

Example 8.12

MKZ airlines is planning to purchase 3 Cessna aircraft to fly at a specific route. The cost of acquisition of aircraft (including all charges) is $ 2,000,000. It is expected that annual net revenue from operations will be $ 650,000 for three years (always end of the year) and thereafter the aircraft will be sold for $ 800,000 at the end of the third year. Assume the discount rate is 3.5%. Please calculate the discounted payback period for this project.

|

Column 1 |

Column 2 |

Column 3 |

Column 4 |

|

Time |

Cash flows (Example 8.5) |

Present value |

Cumulative cash flow (Discounted cash flow) |

|

0 |

-2,000,000 |

-2000000 |

-2000000 |

|

1 |

650,000 |

628019 |

-1371981 |

|

2 |

650,000 |

606782 |

-765199 |

|

3 |

1,850,000 |

1668594 |

903395 |

Same as before, in column 4, we just keep adding present value of each cash flow to the previous remaining value. Accordingly, in cell that corresponds to time = 0, the value of cumulative cash flow is minus 2 million. Similarly, as we proceed to the cell that corresponds to time = 1, we add the present value of cash flow of 650,000 i.e. 628019 to -2,000,000 to get -1,371,981. Then as we proceed to next cells (time = 2 and time = 3), we repeat this calculation to discover that the cash flows become positive for the first time between 2 and 3 years. Since we had to cover -765,199 but actually covered 1,668,594, we can divide 765199/1668594 to obtain 0.46 years.

Consequently, the project discounted payback period is 2.46 years.

Video demonstration of this example in MS Excel here.

8.6: Internal Rate of Return

Net present value provides information to managers in dollar values. However, investors and top management like to view numbers more in terms of percentages. It is therefore important to compare the cash flows from the project with other rates or return from the markets such as yields from bonds or CDs or even returns from the stock markets.

So, the internal rate of return is defined as the rate at which the net present value of the project is zero. In other words, it is the rate beyond which if we increase the opportunity cost of capital (market rate), then the project we are planning to undertake becomes infeasible. Recall that if market rate increases, our project becomes less and less feasible. Internal rate of return is calculated using trial and error. It is achieved by using the rate function in a very simplistic cash flow situation in Excel. However, for non-uniform cash flows, there is an IRR function available.

Example 8.13

Let us find some internal rates of return for our projects in the previous solved examples. In Table 8.3c below, we list out the cash flows of the three projects we have discussed extensively so far in this chapter, and using Microsoft® Excel, we calculate the IRR.

|

Example 8.1 |

Example 8.3 |

Example 8.5 |

|

-$2,000,000 |

-$2,000,000 |

-$2,000,000 |

|

$2,700,000 |

$2,050,000 |

$650,000 |

|

|

|

$650,000 |

|

|

|

$1,450,000 |

|

35% |

2% |

15% |

Video demonstration of this example in MS Excel here.

We can see that investing in the project and getting high returns early (comparing Example 8.1 and Example 8.2 cash flows) produces higher internal rate of return (35% - Example 8.1 over 2% - Example 8.3). Similarly, longer duration projects produce greater cash value to the project by offering multiple cash flows and therefore greater IRR (Example 8.5 over Example 8.3). IRR in Example 8.5 is greater on an account of more cash flows. (15% - example 8.5 > 2% - example 8.3).

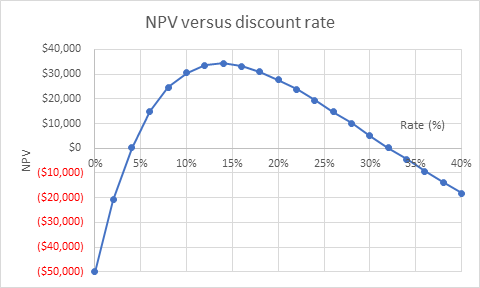

Recall, there is only one sign change in cash flows of a projects discussed before. When there are multiple sign changes, then the project may have multiple IRRs.

Example 8.14

Consider the cash flow sequence in Table 8.9 below.

Find out the IRR and create the NPV profile at different rates of discount.

|

Time |

Cash flows |

|

0 |

-2,000,000 |

|

1 |

1,000,000 |

|

2 |

1,000,000 |

|

3 |

1,000,000 |

|

4 |

1,000,000 |

|

5 |

1,000,000 |

|

6 |

1,000,000 |

|

7 |

1,000,000 |

|

8 |

-9,000,000 |

|

9 |

3,700,000 |

Consider the same project as discussed above. Now, the set-up cost is $ 2,000,000. The project produces consistent cash flows of $ 1,000,000 from periods 1 – 7. However, MKZ airlines decides to invest further in the project. It invests $ 9 million more and gets $ 2,000,000 cash inflow. Thereafter, it determines that the project is likely to be infeasible and sells it for $ 1,700,000.

The project net present values are shown in Table 8.10 below:

|

Rate |

NPV |

|

0% |

($300,000) |

|

2% |

($111,204) |

|

4% |

$24,436 |

|

6% |

$118,580 |

|

8% |

$180,436 |

|

10% |

$217,285 |

|

12% |

$234,879 |

|

14% |

$237,766 |

|

16% |

$229,537 |

|

18% |

$213,027 |

|

20% |

$190,470 |

|

22% |

$163,623 |

|

24% |

$133,863 |

|

26% |

$102,265 |

|

28% |

$69,664 |

|

30% |

$36,704 |

|

32% |

$3,879 |

|

34% |

($28,438) |

|

36% |

($59,973) |

Figure 8.2 below depicts these net present values at different discount rates.

Video demonstration of this example in MS Excel here.

8.7 Profitability index

Net present value of a project is one of the most popular way of assessing a project. Internal rate of return is another way to move beyond the initial set up cost, which the net present value tends to get stuck at. In order to assess and compare multiple projects with a positive net present value, profitability index is a very popular measure. It is the ratio of net present value per unit initial investment.

In Example 8.15, we attempt to compare different projects with different set-up costs and net present values to compare them.

Example 8.15

Please compare projects 1, 2, 3 and 4 below with respect to PI and make a recommendation

|

|

Set up cost |

Net Present value |

PI |

|

Project 1 |

2,000,000 |

905,395 |

45% |

|

Project 2 |

1,500,000 |

709,350 |

47% |

|

Project 3 |

250,000 |

95,000 |

38% |

|

Project 4 |

5,000,000 |

1,800,500 |

36% |

As can be seen in Table 8.11, project 4 is the most expensive project and is also not as profitable as project 2.

Video demonstration of this example in MS Excel here.

What if we have $ 5 million to invest in a single project? Then, we cannot really invest in any other projects except project 5. In other words, we cannot invest in two project 2s and one project 1 to make up for the $ 5 million. This could then be problematic. That is why companies are always looking for projects that are not only profitable but also tailored to their specific investment needs. This is where profitability index becomes more useful. It helps us rank projects by the NPV per unit investment. But it also helps figure out which projects can be accepted using a combination of concepts of NPV and profitability per unit dollar invested.

Summary

This chapter presents several techniques to determine the usefulness, profitability, or selection criteria of new projects for an organization.

The net present value (NPV) of a project is used to assess the difference between the outlays on a project and the present value of inflows from the project to determine the feasibility. If investors have multiple options to choose, then the internal rate of return (IRR) is a better way to compare projects. However, IRR has its own drawbacks and pitfalls. If a firm faces capital shortfall, then profitability index is used to determine the most "investible" project. Payback rule is a thumb rule used to determine how quickly a project returns the money invested. Discounted payback is another method obtained by modifying the payback period cash flows to account for time value of money. An equivalent annual annuity is used to compare different projects with different number of cash flows. Profitability index is a method to compare projects' net present value per unit initial investment and is an attractive method to compare different projects with different set-up costs if cost of investment is not the criterion.

Some of these methods will be put into use in the next chapter when we learn to identify cash flows from different activities for a firm.

Resources

Self Assessment

This self assessment can help you check your growing knowledge from this chapter. You can take the self-assessment as many times as you would like to check your understanding.

Short Answers and Activities

These activities will help you begin applying concepts in this chapter:

- Activity 8.1 Instructions for Activity 8.1

- Blank Excel file:

- Please fill out green cells only

- Activity 8.1 blank

- Activity 8.2 Instructions for Activity 8.2

- Blank Excel file:

- Please fill out green cells only

- Activity 8.2 blank

- Activity 8.3 Instructions for Activity 8.3

- Blank Excel file:

- Please fill out green cells only

- Activity 8.3 blank

A method of evaluating projects with different life durations.

Time in which cost of the project is covered with the help of cash inflows.