2 Financial Markets and Institutions

Chapter 2

Overview

In Chapter 1, we introduced financial assets as a contract which underlies certain financial transactions. Financial assets are used by corporations to raise capital. For this purpose, corporations go to financial markets. Financial Markets are markets (i.e. where buyers and sellers meet) in order to trade financial instruments. Financial Institutions are organizations that deal with financial and monetary transactions. Chapter 2 focuses on the introducing financial markets and institutions to the students. This chapter also discusses the role played by Financial Markets and Institutions during the COVID Crisis of 2020 that led to a small but very sharp downturn in the economy.

Learning Objectives

Following this chapter, students should be able to:

- Describe financial markets and institutions.

- Describe the basic structure of

- Primary and secondary markets.

- Debt and equity markets

- Organized and over the counter markets

- Capital and money markets

- Describe the functions of financial markets and institutions.

- Analyze the main events in financial markets and institutions that happened during the COVID crisis of 2020

2.1 Financial Markets, Assets and Institutions

One of the principal components of Corporate Finance is the creation and exchange of financial instruments (also called financial assets or financial securities). The creation of financial instrument is called issuance , and the exchange of financial instruments is called trading. In this chapter , we

- discuss the physical place or arrangement where these financial assets are first created and then traded.

- define and describe different financial instruments.

- describe the nature of different financial institutions that deal with these financial instruments, and

- discuss the risk attached with financial securities

- describe events related to financial markets associated with the COVID crisis of 2019-2020

A financial instrument is defined as a contract that backs a real asset with future cash flows. Therefore, a share of a company is an example of a financial instrument, so is a bond. In subsequent chapters, we will describe the cash flows from these financial instruments. Other terms used for a financial instrument are financial security or a financial asset.

A financial institution is a place or an organization that is involved in buying/ selling or issuance of a financial instrument.

2.2 Types of Markets

Markets can be divided into various types. Some of them are:

- Primary and secondary markets.

- Debt and equity markets

- Capital and money markets

- Organized and Over the Counter (OTC) markets

- Other markets

2.2.1 Primary and Secondary Markets

In a primary market, new security can be issued using different methods. A security could be issued by direct placement or direct sale from an issuer (someone who accepts money today in return for future cash flows) or through when-issued markets (where security prices are still explored before the actual issue date) or through an initial public offering (IPO).

An issuer is a counterparty (a proxy term for a person or an entity) that receives the money today from an investor (a proxy term for someone who sends the money to the issuer) in return for expected future cash flows.

In a secondary market, these issued securities are exchanged between investors. Sometimes, one of these investors could be the issuer itself. Since this is not an “issue” of financial instrument anymore, the issuer participating in a secondary market transaction is invariably buyback of own issued securities. Secondary markets are invariably involved on exchanges. As an example, when we purchase and sell shares of stock we usually participate in a secondary market unless we purchase directly from the issuer. This is because the shares that we buy/ sell have already been issued at some other date.

An exchange is a location that moderates the “exchange” of a financial instrument from a buyer to a seller. The process involved in settling such a transaction is the smooth transfer of ownership to the new asset holder either via paper or more likely electronically. In return, funds are transferred from the buyer to the seller’s account in a financial institution. Table 1 below summarizes primary and secondary market instruments according to different issuers.

| Issuer →

Issue type↓ |

Government

|

Corporation

|

Bank

|

| Primary | Initial placement/ when issued market | Initial public offering for stocks

Bond issue |

Initial public offering for stocks

Bond issue Also issue certificate of deposits (CDs) |

| Secondary | Bond trading | Stock/ bond trading | Stock/ bond trading

CDs are traded less often |

2.2.2 Debt and Equity Markets

In a debt market, money is borrowed and in return the borrower issues a contract or an agreement (called debt agreement). The definition of borrowing is that cash is taken for a purpose of business and return certain cash flows are promises to the lender. These cash flows are linked with interest rates that are driven by bond markets.

Debt issuance and risk

One of the biggest issuers of debt is the US federal government. The federal government issues debt for 3 months, 6 months, 1 year, a few years such as 3-, 5-, 7- years or for longer durations up to 30-years. These periods of issuance of debt instruments are also called term to maturity. The federal government is considered safe. So, the government can issue debt market instruments for lowest possible interest rates. However, other issuers are not so lucky. They have to issue debt at interest rates which are higher for comparable terms (to maturity). This is called risk. We will discuss these concepts in detail in subsequent chapters. Table 2 below describes the term of a debt instrument and its nomenclature depending on the issuer.

| Issuer →

Term↓ |

Government

|

Corporation

|

Bank

|

| On Demand | Savings/ checking deposit/ money market accounts | ||

| < 1 year | Treasury Bills | Commercial Papers | Fed Funds window/ interbank borrowing/ Certificate of deposit (usually > 30 days) |

| > 1 year and < 10 years | Treasury notes | Debenture/ Term loan/ Notes | Certificate of deposit |

| > 10 years | Treasury Bonds | Debenture/ Term loan/ special purpose loan[1] | Certificate of deposit |

| Infinite | Perpetual bonds | N/A[2] | N/A |

As seen in table 2, different issuers need funds for different duration depending on their liquidity needs. Hence, they issue different financial instruments according to these needs. Table 3 below describes financial instrument and instrument type issued by either the government or corporations depending on their financial needs.

| Issuer type | Instrument | Instrument type |

| Government | Currency, treasury bill, note and bond | Cash and short term |

| Corporate issuers | Exchange traded fund | Equity/ debt/ commodity/ crypto currency/ ESG |

| Corporation | Commercial paper, debenture, note | Debt |

In equity markets, stocks are traded. As we have seen, a share or stock is an equal ownership in a company. Stocks are traded on stock exchanges. In the United States, there are two major stock exchanges: the New York Stock Exchange (NYSE) and the NASDAQ (the National Association of Securities Dealers Automated Quotations). In the past, there was a difference in the way stocks were traded on these exchanges. While brokers were the primary persons on the NYSE, it was the dealers who were involved in placement and execution of trades on the NASDAQ.

Brokers are persons who are responsible for finding a buyer for a seller and vice versa. However, on most occasions there are so many buyers and sellers that their bids (purchase price) and offers (selling price) are placed in an order that trades can take place once the purchase and/ or sale prices are reached.

Brokers collect orders from investors and the bid and offer orders are listed on the stock exchange. An exchange such as NYSE is a free marketplace where stocks are traded between buyers and sellers via brokers. On the other hand, NASDAQ has traditionally been associated with dealers or entities that are legally required to provide two-way quotes to buyers and sellers — a bid and offer price. The way dealers make money is through the spread on these two-way quotes unlike brokers who earn money through commissions on purchase/ sale of securities. So, instead of looking for a buyer for a seller of financial instruments and vice versa investors can directly approach the “counter” at NASDAQ and place their trade with the dealers who are required to give a two-way quote.

US treasury bonds are also placed via primary dealers. Because of their role in buying as well as selling of instruments, dealers are called market makers. However, in practice it is very difficult to be a market maker for stocks as stocks sometimes constantly lose value for extended period of time. So, there is a risk of dealers going bankrupt during such times.

Delta Air Lines File for Chapter 11 Bankruptcy

The year 2005 became a very turbulent year for Delta as the company filed for bankruptcy protection after racking up more than $10 billion in losses since 2001. Hence, they were not in a position to repay some of the bonds they issued in prior years as well as loans they took from banks. That is why they had to seek Chapter 11 protection. Chapter 11 is a form of bankruptcy protection that involves reorganization of debtor's business affairs, assets and debt. In addition, if a company is filing for Chapter 11 protection chooses to follow a reorganization plan, it must do so to protect the interests of lenders.

To support its business during Chapter 11 proceedings, Delta negotiated to receive a commitment for $1.7 billion in debtor-in-possession (DIP) financing from GE Commercial Finance and Morgan Stanley as Co-Lead Arrangers (Ramos, 2005). In other words, to fund any financial needs, Delta received a financial support of that amount. Hence this DIP would be a debt market instrument that cannot be traded on an exchange because it is specific to Delta. Sometimes during reorganization of the firm, the company may find that its assets are insufficient to protect all its liabilities even after receiving new financing. This can lead to a haircut for its lenders, a process in which lenders receive only a part of their funds back. However, a haircut is still better than receiving nothing at all.

There were few crucial reasons behind declaration of bankruptcy: rising crude oil price, labor charges and operation of unprofitable routes as a part of its legacy business. Oil prices had been climbing since the year 2003 and reached record highs. Since fuel cost is a considerable part of the cost structure of any airline, rising fuel costs create pressure on profitability of airlines. Fuel costs can typically comprise 20%-30% of the operating expense of an airline company. Factors that influence price of fuel include geopolitical (break in supply) and economic factors (strong demand). However, Delta Air Lines Inc. emerged from bankruptcy on April 30, 2007, following a 19-month hiatus and $3 billion in restructuring cost. The carrier thwarted a hostile takeover, cut costs and jobs, and eliminated some unprofitable routes during this period.

2.2.3 Capital and Money Markets

Finally, there are capital and money markets. These are differentiated exclusively by the term to maturity (recall that term to maturity is the duration in which the instrument will expire) of the instrument that was issued. Any instrument that was issued for more than 1 year is a capital market instrument. The rest are money market instrument. The nature of money market instruments is to tide over short-term liquidity situation for the issuer. So, treasury bills, commercial papers and short-term CDs or Fed funds window for banks are all money market instruments. However, long-term bonds are capital market instruments. So, even if a 30-year bond is due to mature in next week, it is still a capital market instrument because it is a bond that is issued for more than 1 year. Since stocks have no maturity, these are capital market instruments.

The importance of either type of instrument cannot be discounted enough. For example, Delta airlines has a special program for its Sky Miles. Since the program is medium-long term in nature, the bonds issued to finance the program are typically capital market instruments. However, if Delta wants to pay short-term fuel costs, then it could finance that by the way of say a 30-day commercial paper to pay the supplier and offset it by any sales revenues it receives from flying those commercial flights. These commercial papers are a money market instrument. In table 2 above instruments with a life of one year or less are money market instruments and those with term to maturity from issuance date of greater than 1 year are capital market instruments.

2.2.4 Organized Versus Over-The-Counter Markets

Brokers are listed as main participants in organized markets. Therefore, organized markets usually involve brokers to trade with each other. Retail customers can open accounts with brokers and trade through brokers with each other. Up to as late as 2010s, brokers used to charge a fee until new brokers such as Robinhood created a trend of not charging a fee per trade. The rationale behind charging a fee was that brokers needed to contact interested counterparties on the other side of the trade. This involved time and transaction costs. However, with availability of information over the internet, this became more and more easy. Therefore, we do not see brokers falling over each other at exchanges outbidding each other anymore. Stock exchanges all over the world typically operate in organized markets such as the New York Stock Exchange (NYSE).

In over-the-counter markets there are no brokers but broker-dealer networks. Institutions can issue or trade instruments not in a listed exchange, but more or less through the broker dealer network. Securities listed on over-the-counter (OTC) markets do not need to follow all the stringent requirements of securities listed on stock exchanges and organized markets. Securities in over-the-counter markets could also be traded by limited participants. As an example, government bonds, corporate bonds or penny stocks could be traded in these markets. To buy or sell these securities, all that is needed is a counterparty that has opposing view and is willing to act on it. For example, if we want to sell government bonds, we need someone to buy it. OTC markets do not have a centralized source of all necessary information. OTC markets are not located at a single location, i.e., these are decentralized. Bonds, debentures, commercial papers and tradeable certificate of deposits, penny stocks, venture markets are some examples of securities traded and deals being made at OTC markets.

2.2.5 Other Markets

There are other types of financial markets, particularly relevant to aviation. These are foreign exchange markets, commodity markets and derivatives. These are all very important for a finance professional in aviation.

Commodity Markets

In commodity markets, goods such as crude oil, jet fuel, grains, metals and raw materials are exchanged between buyers and sellers. Since delivery of commodity takes place much later than the spot deal, there are two types of prices: spot prices and futures. The spot price is the cash cost of a commodity for immediate delivery. However, not all commodities can be delivered instantaneously.

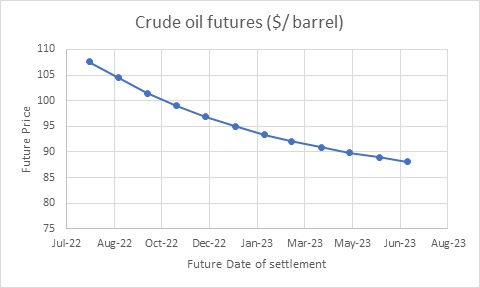

For example, in crude oil markets, futures prices are available for delivery 2 months to 1 year out. When we estimate that future demand for crude oil is going to be higher than today (such as during the middle of the pandemic in May 2020), the spot price may be much lower than future prices. Such a type of market is said to be in contango. On the other hand, there is a huge immediate demand for crude oil. Then spot prices tend to shoot up as compared to the future prices.

During the 2022 period when inflation was spiking due to crude oil shortages from geopolitical tensions, spot prices were much higher than future prices because it was expected that oil companies would bring back online those production units/ refineries etc. to create greater capacity for delivery. Such a market is said to be in backwardation.

Commodities are traded on exchanges such as The Intercontinental exchange (popularly known as ICE futures US or Europe), the Chicago Mercantile Exchange (CME), the London Metal Exchange (LME), Tokyo Commodity Exchange (TCE)[3]. Figure 2.1 below shows the crude oil futures as of June 26, 2022. What is worth noting that commodities, futures and cryptocurrencies can keep trading even when financial markets in any given country are closed because potentially other countries are still open. However, sometimes the liquidity is really low, meaning that there are not enough buyers and sellers to provide sufficient price discovery.

Foreign Exchange Markets

Foreign exchange markets are another type of market that are particularly important for those airlines that fly international routes and/ or cater to international customers through travel agents abroad. In foreign exchange markets, currency needs to be converted from payments received from customers abroad into domestic currency. Currency conversion involves foreign exchange markets. Foreign exchange markets are typically existent among banks. However, large multinational corporations have their own foreign exchange divisions that oversee foreign exchange transactions. Banks send funds through SWIFT or society for worldwide interbank financial telecommunications. Payments are made in foreign account of domestic banks and then sent though SWIFT. Currency conversion is based on complex set of economic theory such as interest rate and inflation expectations, protectionism and central bank support and other macroeconomic conditions.

Derivatives Markets

As discussed above, businesses use commodities and other financial instruments for their operations. The prices of products and instruments such as foreign currencies, jet fuel, and other commodities are highly volatile. The fluctuations in their prices may lead to significant risk in their business. To mitigate such risks, businesses widely use financial instruments, called derivatives, whose value is derived from the values of one or more underlying assets. The process of reducing risk by using derivatives and other strategies is called hedging. The market where these derivative instruments are traded is called derivatives markets. Besides using these derivatives by businesses for hedging, many investors buy and sell derivatives for speculative purposes. So, there is a vast derivatives market. The most common derivatives instruments are forwards, futures, options, warrants, and swaps. The five largest derivatives exchanges in 2021 by the number of contracts traded are: the National Stock Exchange of India, A Bolsa do Brasil (B3), CME Group, Intercontinental Exchange, and Nasdaq.

2.3 Financial Intermediaries

A financial intermediary is defined as an organization that transfers money from lenders to borrowers. A natural question is - why are financial intermediaries required? The answer to this is that there are several types of savers/ investors/ lenders. Importantly, these can be classified as large and small. Small or retail lenders cannot typically lend to large or corporate borrowers. There are two methods to overcome this problem. The first method is for corporations to reach out directly to all investors small and large through public offerings. However, the problem is that a corporation has to be well known to be able to do this. Large corporations with good credit quality such as Microsoft use this route to raise funds via debt market. However, not all corporations can use this route. This problem of fund- lender-borrower mismatch is solved by financial intermediaries. As companies that specialize in both mobilizing funds from investors and transferring them to borrowers these companies play a crucial role in economic development. In fact, one sign of developed economy is the soundness of its financial markets as measured by the health and diversity of its financial intermediaries.

There are different types of financial intermediaries:

- Banking institutions

- Insurance companies

- Mutual funds, hedge funds, motifs and exchange traded funds

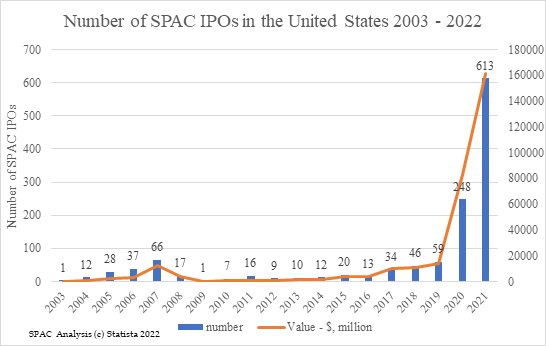

- Special purpose acquisition companies (SPACs)

A bank is an organization that primarily accepts deposits and makes loans. As markets have evolved, so have the complexities of instruments that exist in the markets. For this reason, financial intermediaries such as banks have to rediscover and reinvent themselves constantly. To talk about evolution of different types of banks is a topic of different subject area altogether (Money and Banking). It would suffice to note that banks in the United States are organized as commercial banks, credit unions, and savings and loan associations.

The primary function of all these institutions is said to be making loans and raising the money for these loans from deposits. There are also investment banks that cater to equity markets by helping investors and issuers discover price of a new instrument. This process is called initial public offering and investment banks offer “underwriting services” for price discovery. In the modern times with the evolution of technology, institutions called fintech companies have evolved. The core of these companies is to involve the use of technology for serving customers’ financial needs.

Technology has transformed the world of financial markets and instruments with the help of fintech companies. For example, in the old days, in order to purchase shares of a company, an individual had to open an account with a broker and had to get in touch with the broker to know the latest share prices for investing. However, with the evolution of internet and technology, things became simpler and in order to take a loan from a bank all one needs to do in current times is upload the documents into an “application”. Firms such as Robinhood (a brokerage company) reinvented the wheel for brokers by offering investments in “slice” of a share or part of a share. So an individual does not have to have exact sum of money to buy “n” numbers of shares. Instead, the investor can now purchase $ 50 or $ 100 worth of shares. All these innovations in financial markets and instruments are at the core of what financial technology company does.

The function of a mutual fund is to collect money from individual or retail investors and invest it in several financial instruments in order to achieve a particular goal. The benefit of a mutual fund for a retail investor is that an investor will need large sums of money to invest in several types of stocks. A retail investor also has to constantly monitor the companies in the portfolio, which can be onerous and time consuming. Transferring money to a mutual fund by investing in it often transfers this responsibility on the manager of the mutual fund. These mutual funds have a manager that actively “balance” the portfolio or change the composition of the portfolio by buying and selling stocks within the portfolio in order to try and achieve maximum profits for investors.

An exchange traded fund (ETF) is similar to a mutual fund because several individual investors invest in the ETF, which often consists of multiple financial instruments. The key difference between a mutual fund and ETF is that ETFs are not rebalanced regularly. This leads to ETFs having lower fees being charged to the investors than mutual funds. However, both mutual funds and ETFs provide benefits of diversification to the investor. Some mutual funds and ETFs are closely tied with the overall stock indices by investing in exactly the same stocks as are in the stock market index[4].

Finally hedge funds are funds managed by institutions meant for large net worth individuals (typically ranging in 100s of thousands to millions of dollars per investor). These assets utilize fancy trading strategies such as investment in derivatives, short selling, currencies and commodities, international markets and cross border investments to achieve profits for clients.

Many scholars believe that trying to beat overall markets (i.e. doing better than stock market investments through mutual funds and ETFs) is futile, particularly over medium to long run. We will see this “efficient markets hypothesis” in chapter 7. Some other investors, particularly in behavioral finance contest the notion of efficient markets hypothesis. There was a famous challenge between famous investor Warren Buffet and hedge funds in 2008[5]. Warrant Buffet contested the stipulations of efficient markets and challenged hedge funds to produce better than market returns in ten years. At the end of 2016, when he shared the results, it was clear that the “Oracle of Omaha” had won the bet. Over the ten-year period the S&P 500 index had averaged 7.1% annually while hedge funds’ annual average was 2.1%.

2.4 2020 COVID Crisis

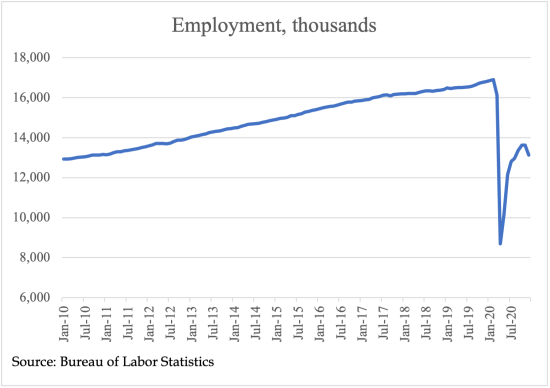

In 2019, there was news emanating out of China about a new virus that was causing people to get really sick and landing many in the hospitals. There were visuals of makeshift hospitals and mass quarantine and lockdowns in major cities in order to curb the control of the virus. However, the virus could not be stopped from replicating globally, which led to transmission in all countries of the world. With no immunity in humans, most countries had to impose a lockdown of some sort in order for scientists to develop vaccines and therapeutics. By February of 2020, cases began growing in the United States. There was a widespread fear of the unknown as the virus began spreading and people began losing jobs. The US economy lost 4 million jobs in the month of April 2020. According to the Bureau of Labor statistics, the number of jobs lost due to COVID pandemic were the most since the great depression of 1930s. See Figure 2.3 below.

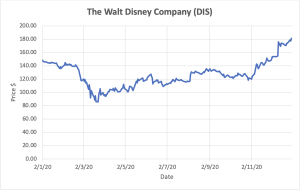

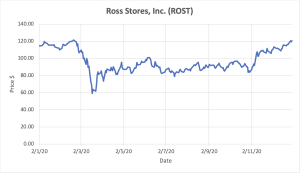

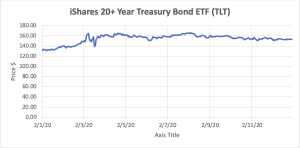

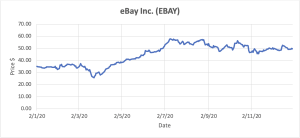

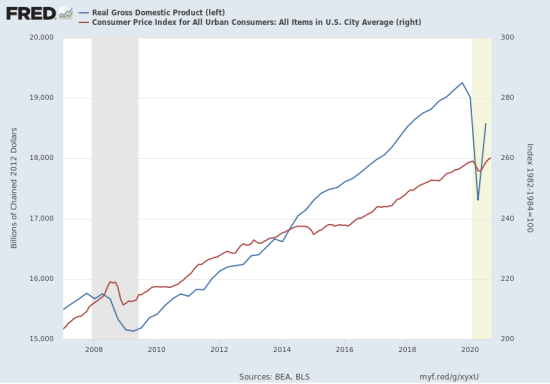

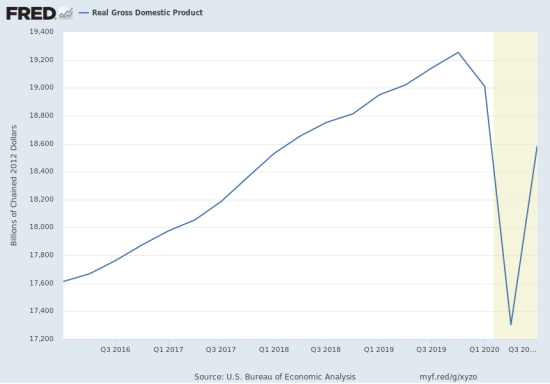

This was the result of a precipitous drop in the level of economic activity as measured by the GDP, which was also seen by stock markets as seen in figure 2.4 below.

Since consumers were forced to stay indoors, demand for most goods and services came to a screeching halt causing a deflation in the economy, as seen in figure 2.5 below.

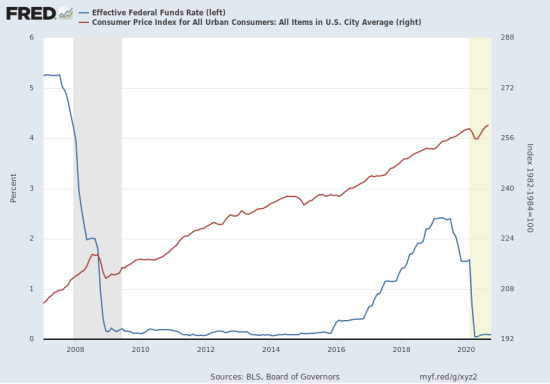

The Federal Reserve (Fed) did not want the economy to sink. Therefore, the Fed cut its interest rates by 50 basis points in February 2020 and kept decreasing the short-term interest rates until they reached zero (as seen in figure 2.6 below), meaning any financial institution if wanting to borrow short term liquidity could do so through the fed funds window at no cost. Thus, the Fed was acting as a lender of last resort.

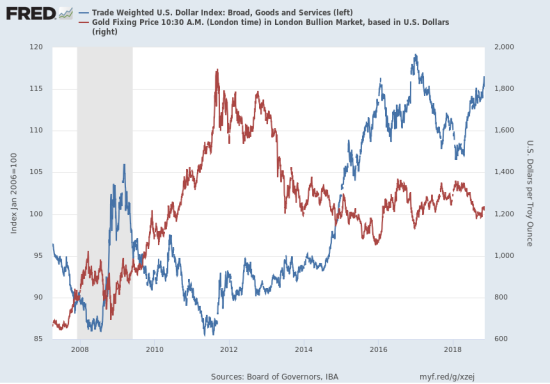

As there was fear in the markets, people initially resorted to buying gold and safe currencies such as the US dollar. Consequently, the US dollar soared in value against a basket of currencies. Since the price of gold is measured in US dollars, even though gold became more valuable, this was negated because of the rise in value of the US dollar. This is seen in figure 2.7 below.

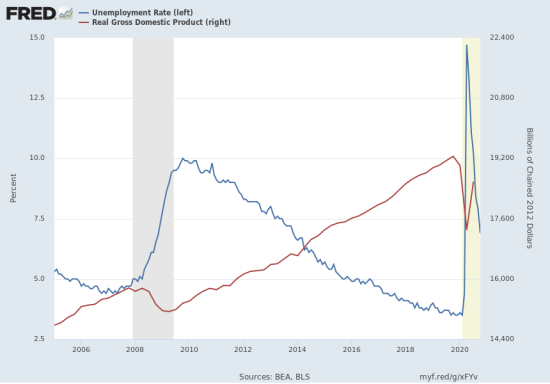

As GDP dropped, the unemployment rate rose to as high as 13% before starting to recover as seen in figure 2.9 below.

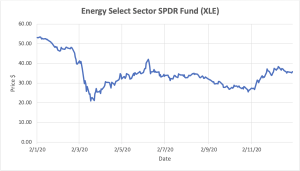

Stocks in some sectors lost significant value such as outdoor/ public entertainment/ leisure (Example: Disney); Dining and restaurants (Darden restaurants, Yum! Brands, Shake Shack, Brinker etc.); Retail (such as Ross stores, TJ Maxx, Macy's, Kohl's, Nordstrom etc.); Commercial property such as malls (SL Green Realty, Simon Property Group, Federal Realty and Kimco Realty). Sectors involved in transportation of passengers such as airlines and cruises; sectors dealing with malls and retail that involved in-person shopping also suffered; sectors involved in indoor interaction/ leisure such as hotels and casinos (Carnival Corp., American Airlines, United Airlines, Boeing, Marriott, Hilton and Wynn) did not fare well either.

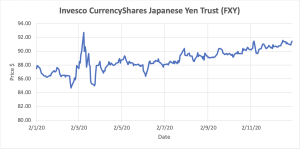

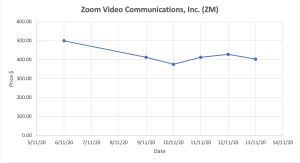

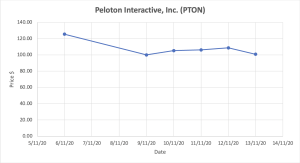

People rushed to the safety of bonds as reflected by soaring prices of bond ETFs. There were sectors that did exceedingly well such as safety (Treasury's (TLT) and Clorox); at-home entertainment such as Netflix; indoor workout sector such as Peloton; at-home shopping such as Ebay and amazon dot com; online services such as DocuSign and Zoom; online payment services such as PayPal and Square Inc. Technology prospered as seen from share prices of Alphabet (parent of Google) and Apple as well as safe havens such as Japanese Yen. On the flip side, the scare led to decline in dollar (UUP).

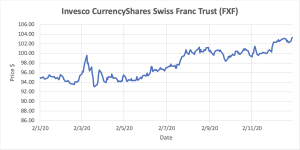

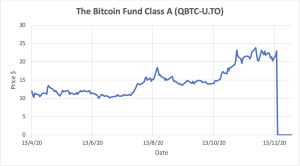

Other safe havens also prospered such as Swiss Franc, Gold and Silver and Bitcoin, while the demand for commodities such as crude oil dropped due to lack of perceived demand.

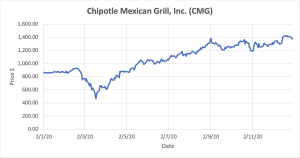

There were some stocks that adjusted to the new normal and adapted very quickly by offering app-based services and delivery such as Chipotle (CMG).

On the day Pfizer announced the vaccine in November, its stock price soared.

It also led to decline in prices of pandemic beneficiary stocks such as Zoom and Peloton.

2.5 Summary

In this chapter we learnt how financial instruments are issued and traded in various financial markets. There was an overview of different types of financial markets. These different markets usually function synergistically. However, sometimes things can go wrong as we saw in the COVID Crisis that led to a sharp downturn in 2020. Next, we will get an overview of firms' balance sheet and important aspects of the balance sheet for a financial manager that help the manager to determine whether the corporation needs funding.

Resources

Self Assessment

Self Assessment part 1

Self Assessment part 2

Short Answer based Activities

These activities will help you begin applying concepts in this chapter:

| Activity 2.1: Activity 2.1

Activity 2.2:Activity 2.2 |

- Delta Air Lines has benefited from the Payroll Support Program Extension (PSP2). The Consolidated Appropriations Act, 2021, was enacted on December 27, 2020. It included an extension of the payroll support program created under the CARES Act (The Coronavirus Aid, Relief, and Economic Security Act), providing an additional $15 billion in grants and loans to the airline industry (Delta 10-K Annual Filing, 2021). ↵

- Although stocks have no maturity, stocks are not defined as “debt.” So, a company can repurchase shares but cannot recall them. Airlines rarely known to buy back stock. ↵

- Link available here ↵

- A stock market index is either a sum or a weighted average of price of stocks of major companies. Three main stock indices in the United States are the Dow Jones Industrial Average (DJIA), the Standard and Poor’s index of 500 stocks (S&P 500) and the NASDAQ 100. The DJIA is a sum of share price of 30 leading company stocks. It is the oldest stock market index. It was created in 1896. However, as the number of companies increased in the economy, just having 30 stocks in the index did not make sense. Consequently, the S&PP 500 index was created in 1957. S&P 500 is the weighted average of share price of 500 top companies in different sectors. Moreover, the weights of companies are regularly adjusted in the index. Finally, the NASDAQ 100 index includes the weighted average of 100 stocks listed on the NASDAQ stock exchange. Since the NASDAQ exchange is “relatively new”, most of the stocks listed on the exchange are related to technology. Hence the NASDAQ 100 is often called the technology index. ↵

- Here is the link to original story ↵

- link to the original story ↵

A contrast that backs a real asset with future cash flows.

A place or organization that is involved in buying/selling or issue of a financial instrument.

Someone who accepts money today in return for future cash flows.

Where security prices are still explored before the actual issue date.

A proxy term for someone who sends the money to the issuer.

Location that moderates the "exchange" of a financial instrument from a buyer to a seller.

Marketplace for debt instruments and securities.

Periods of issuance of debt instruments.

Issuing debt at interest rates which are higher for comparable terms.

People who are responsible for finding a buyer for a seller and vice versa.

The cash cost of a commodity for immediate delivery.

Fund meant to collect money from individual or retail investors and invest it in several financial instruments.

Funds managed by institutions meant for large net worth individuals.